Cash flow per share formula

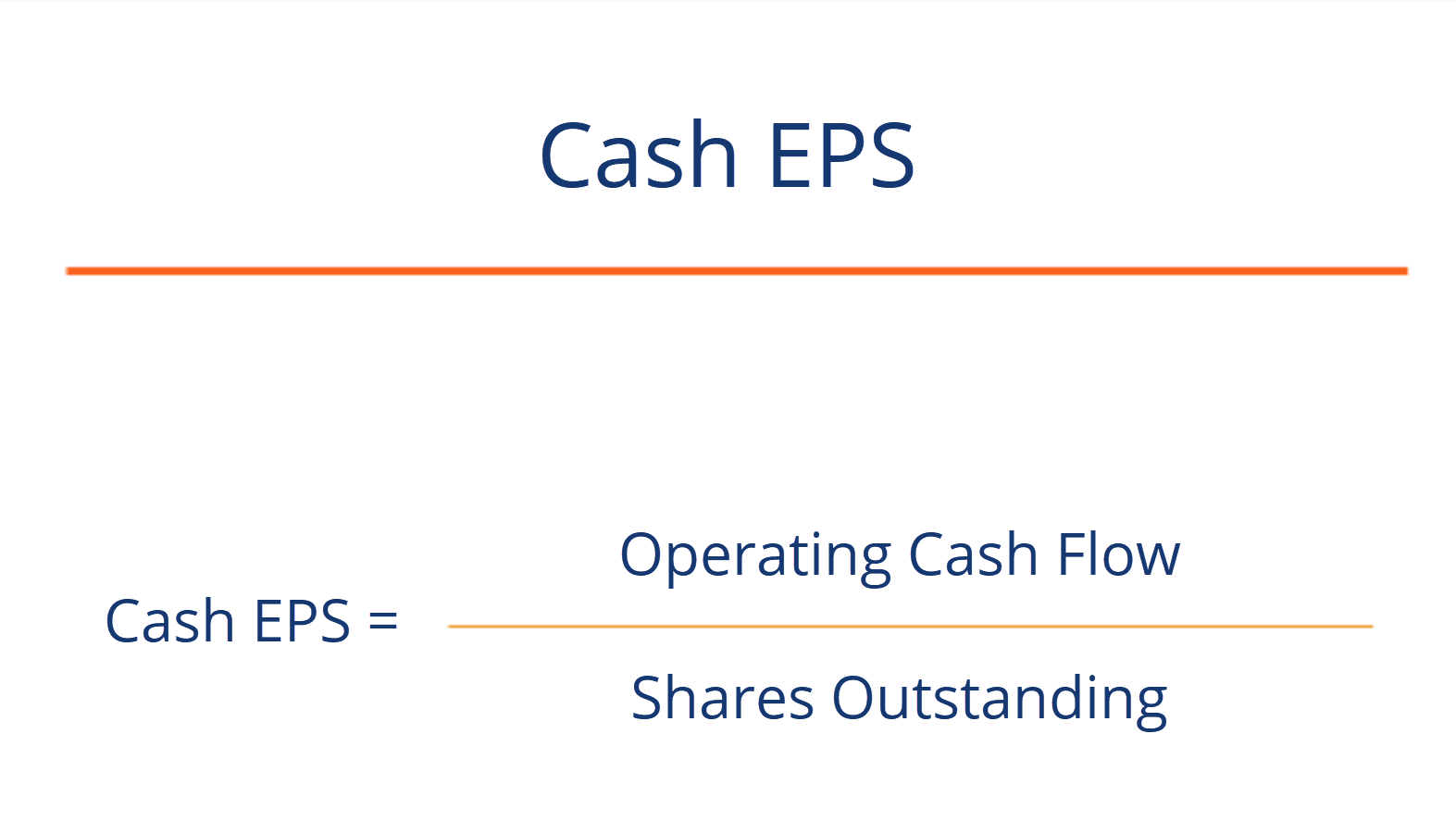

Cash flow per share indicates the financial strength of the firm. Cash Earnings Per Share Operating Cash Flow Diluted Shares Outstanding.

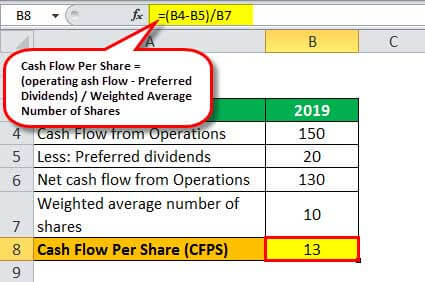

Cash Flow Per Share Formula Example How To Calculate

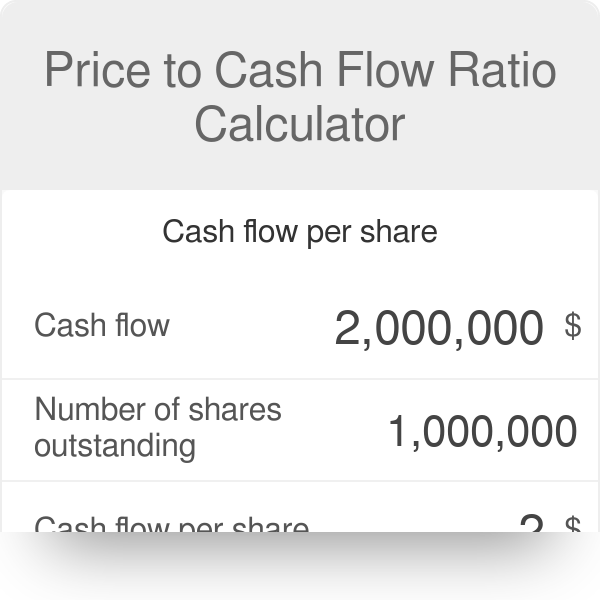

Net cash flows Average number of shares outstanding Cash flow per share The measure is best tracked on a trend line over multiple years in order to discern any long-term changes in cash flow levels.

. Calculate cash flows per share for 2013 and 2014 and contrast it with earnings per share for the relevant years. It is often used as a financial ratio to determine the liquidity of the company and the amount of war chest that it has to scale the company. Cash Per Share is also used to compare across companies to determine how well-funded a company is.

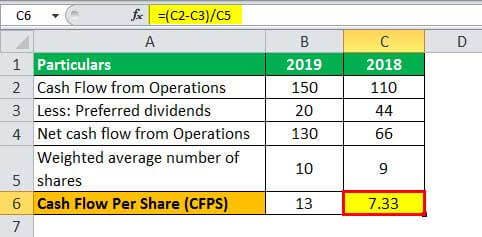

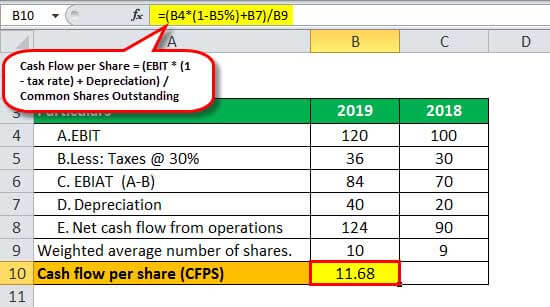

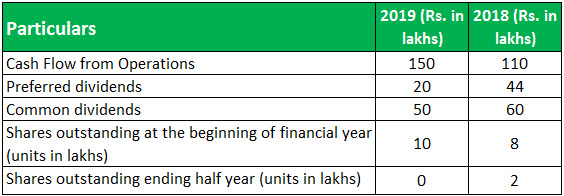

To calculate cash earnings per share you just need to divide your operating cash flow by the diluted shares outstanding. It shows the cash flow of each share of the stock. Cash Flow Per Share Cash Flow Per Share Operating Cash Flows Preferred Dividends Total Number of Common Shares Outstanding However there are numerous variations of the cash flow per share metric wherein free cash flow FCF metrics such as free cash flow to equity FCFE is used instead.

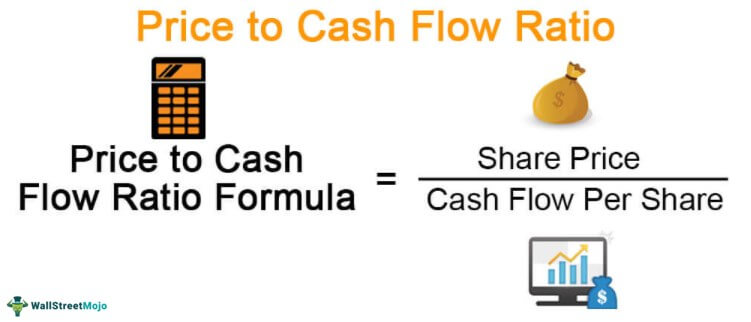

Cash Flow Per Share Operating Cash Flow Number of Outstanding Shares. Operating Cash Flow Per Share Formula Operating Cash Flow Per Share Operating Cash Flow Number of Outstanding Shares Operating Cash Flow Per Share Example We will use Apple Inc as an example to calculate its Operating Cash Flow Per Share as of 1 March 2022. Once we know the cash flow per share we would be able to calculate the price to cash flow ratio very easily.

This makes cash flow per share a more attractive indicator. Cash per share CPS measures how much cash a company has on hand on a per-share basis. Begin alignedtext Cash EPS frac text Operating Cash Flow text Diluted Shares Outstandingtextbf wheretext EPS text earnings per shareend aligned Cash EPS.

This formula will tell you how much cash flow the company generates on a per share basis. Cash flow information is available on a companys statement of cash flows. Cash Flow Per Share Formula.

Rated the 1 Accounting Solution. Ad QuickBooks Financial Software. Interpretation Many investors get busy in calculating price to earnings ratio.

Free cash flow is the amount of money a company has left over after it has made any necessary capital expenditures. What is cash flow per share. All amounts are in million USDs.

The formula for cash flow per share is. Please use the mathematical deterministic number in field to perform the calculation for example if you entered x greater than 1 in the equation ysqrt 1-x the calculator will not work and you may not get desired result. We will use Apple Inc as an example to calculate its Cash Flow Per Share as of 1 March 2022.

So take a long breath and start reading. During the same time frame the company had a total of 10 million shares outstanding. Operating Cash Flow Net income Depreciation and amortization Stock-based compensation Other operating expenses and income Deferred income taxes Increase in inventory Increase in accounts receivable Increase in accounts payable Increase in accrued expense Increase in unearned revenue.

It is calculated as follows. Cash Flow Per Share Cash Flow - Preferred Dividends Shares Outstanding Lets assume that during the fourth quarter Company XYZ reported cash flow of 4 million and distributed preferred dividends of 500000. Cash flow per share can be determined by taking the operating cash flow subtracting the preferred dividends and then dividing by the number of common shares outstanding.

In this segment we will learn how to calculate cash flow per share and use Apple Inc as a step-by-step example. Find the Operating Cash Flow. Cash Per Share refers to the amount of cash that a company has for every share.

So the formula would look like this. In fact I included example and formula too. Solution We need to calculate weighted average number of common shares for both.

Cash Flow Per Share Example. This article is filled with information on cash flow per share. It can also be expressed as a financial ratio that can be calculated by tallying up a companys total cash on.

So to calculate the cash flow per share we would do the following Cash flow per share Operating Cash Flow Outstanding Shares.

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Net Cash Flow Formula Calculator Examples With Excel Template

Free Cash Flow Formula Calculator Excel Template

Cash Flow Per Share Formula Example How To Calculate

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow Per Share Formula And Calculator Excel Template

Fcf Formula Formula For Free Cash Flow Examples And Guide

Cash Flow Per Share Formula Example How To Calculate

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Per Share Formula And Calculator Excel Template

Cash Flow Per Share Formula Example How To Calculate

Cash Flow Formula How To Calculate Cash Flow With Examples

Price To Cash Flow Ratio Calculator Calculate P Cf Ratio

Price To Cash Flow Ratio P Cf Formula And Calculation Excel Template

Cash Flow Per Share Formula Example How To Calculate

Cash Eps Operating Cash Flow Divided By Shares Outstanding

Price To Cash Flow Ratio Formula Example Calculation Analysis